Clark Wealth Partners Things To Know Before You Get This

Wiki Article

All About Clark Wealth Partners

Table of ContentsLittle Known Facts About Clark Wealth Partners.The Basic Principles Of Clark Wealth Partners Clark Wealth Partners Things To Know Before You Get ThisThe Clark Wealth Partners IdeasFacts About Clark Wealth Partners UncoveredRumored Buzz on Clark Wealth PartnersSome Of Clark Wealth Partners

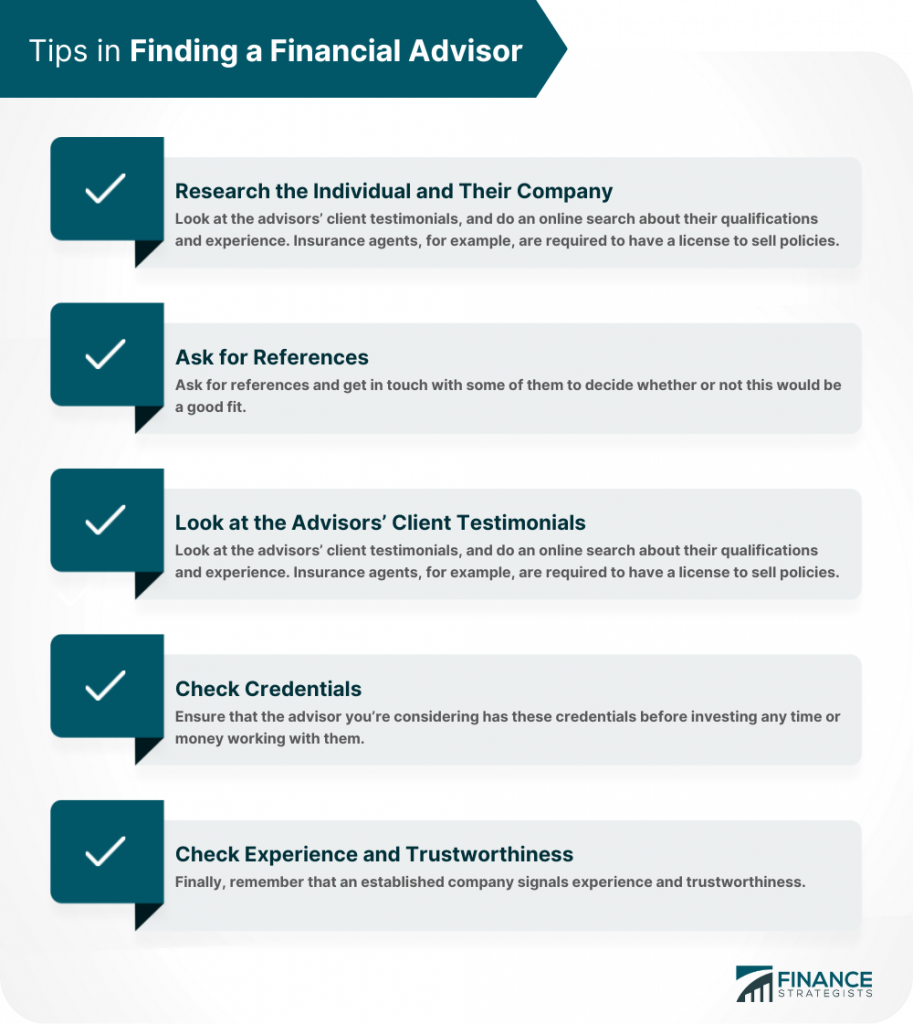

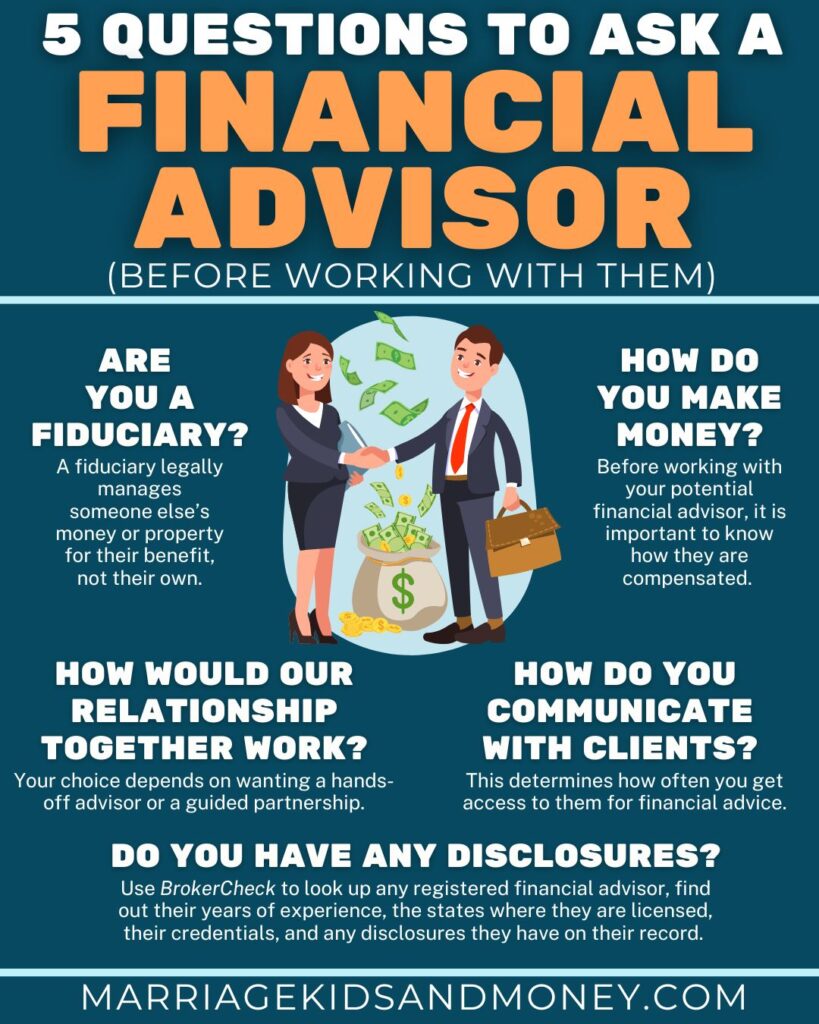

These are professionals that give investment guidance and are registered with the SEC or their state's safeties regulator. Financial experts can likewise specialize, such as in student fundings, elderly demands, tax obligations, insurance policy and various other facets of your finances.Not constantly. Fiduciaries are legitimately called for to act in their customer's finest rate of interests and to keep their money and property different from various other assets they manage. Just economic consultants whose classification needs a fiduciary dutylike licensed financial organizers, for instancecan claim the same. This difference also means that fiduciary and financial consultant fee frameworks vary as well.

The 5-Second Trick For Clark Wealth Partners

If they are fee-only, they're a lot more likely to be a fiduciary. Many credentials and designations need a fiduciary obligation.

Selecting a fiduciary will ensure you aren't steered towards certain financial investments due to the payment they provide - financial company st louis. With great deals of money on the line, you might want a financial expert that is legally bound to utilize those funds carefully and only in your ideal passions. Non-fiduciaries may suggest financial investment items that are best for their pocketbooks and not your investing objectives

The 20-Second Trick For Clark Wealth Partners

Increase in savings the typical household saw that functioned with a financial expert for 15 years or more compared to a comparable family without a financial advisor. "Extra on the Worth of Financial Advisors," CIRANO Task Information 2020rp-04, CIRANO.

Financial suggestions can be helpful at turning factors in your life. When you fulfill with an adviser for the very first time, work out what you desire to get from the recommendations.

What Does Clark Wealth Partners Mean?

When you've accepted go in advance, your monetary advisor will prepare an economic prepare for you. This is provided to you at one more conference in a paper called a Declaration of Advice (SOA). Ask the advisor to clarify anything you don't comprehend. You ought to always really feel comfortable with your consultant and their recommendations.Urge that you are informed of all transactions, which you obtain all communication pertaining to the account. Your adviser might recommend a managed discretionary account (MDA) as a way of managing your investments. This involves authorizing an arrangement (MDA contract) so they can buy or market financial investments without having to get in touch with you.

Not known Incorrect Statements About Clark Wealth Partners

Before you spend in an MDA, compare the advantages to the costs and risks. To secure your money: Don't offer your adviser power of lawyer. Never sign a blank record. Place a time limit on any type of authority you offer to deal financial investments in your place. Insist all document concerning your financial investments are sent out to you, not simply your advisor.If you're relocating to a new advisor, you'll need to arrange to move your monetary documents to them. If find out here you require assistance, ask your advisor to describe the process.

will retire over the following decade. To fill their footwear, the nation will require more than 100,000 brand-new monetary advisors to go into the sector. In their everyday work, monetary consultants manage both technological and innovative tasks. United State News and Globe Record rated the role amongst the leading 20 Finest Organization Jobs.

Clark Wealth Partners - Questions

Aiding people achieve their monetary goals is a financial advisor's primary feature. But they are likewise a small company owner, and a part of their time is committed to handling their branch workplace. As the leader of their method, Edward Jones monetary consultants need the management abilities to work with and handle personnel, in addition to business acumen to develop and carry out a business approach.Investing is not a "collection it and neglect it" task.

Financial consultants should set up time weekly to fulfill new people and catch up with individuals in their sphere. The financial solutions market is greatly controlled, and regulations transform typically - https://myxwiki.org/xwiki/bin/view/XWiki/clrkwlthprtnr?category=profile. Numerous independent monetary consultants spend one to 2 hours a day on compliance tasks. Edward Jones financial advisors are lucky the office does the heavy training for them.

An Unbiased View of Clark Wealth Partners

Edward Jones monetary advisors are motivated to go after additional training to expand their knowledge and abilities. It's also a good concept for economic experts to participate in industry conferences.Report this wiki page